Disclaimer: This article is for informational purposes only and should not be considered tax, legal, or financial advice. For specific guidance, consult a tax professional or the IRS directly.

Receiving a CP518 notice from the IRS means the agency has no record of a required tax return. Ignoring this final reminder can lead to penalties, interest, or the IRS determining your taxes for you. Here’s how to resolve it using Form 15103.

What Is a CP518 Notice?

The CP518 notice is sent when the IRS hasn’t received a tax return they believe you are required to file. Consequences for not responding include:

- IRS calculating your taxes without your input

- Accruing penalties and interest

- Delayed refunds for current or prior years

Steps to Resolve a CP518 Notice

1. File Your Tax Return As Soon As Possible

Submit your overdue tax return to the address on the notice to avoid further penalties. Be careful before buying tax software to complete this, as not all software will allow you to prepare prior-year returns. You may want to consider having a tax professional assist with preparing your return.

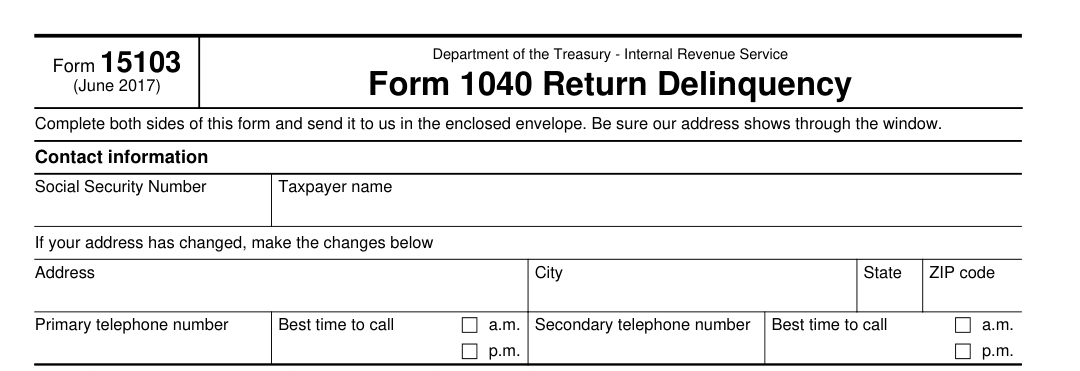

2. Complete Form 15103 (Form 1040 Return Delinquency)

This form is essential for explaining your situation. Use it to:

- Explain why you’re filing late

- Indicate why you believe you don’t need to file

- Confirm that you’ve already filed

Send Form 15103 and your tax return by mail or fax, as instructed in the notice. Use a secure fax service if faxing.

Important: Respond Quickly

Delays in addressing the CP518 notice can result in the IRS taking action to calculate your taxes and additional interest accruing.

If you have received a CP518 and are unsure why or how to respond, you may want to contact an Enrolled Agent or similar tax professional.

What to Do If You Disagree

If you think the notice is incorrect, call the toll-free number listed on the CP518 notice with your account information. Alternatively, mail Form 15103 with an explanation of your disagreement.

An Enrolled Agent or other tax professional can also provide representation for your during this process. You may want to contact a tax professional to discuss the situation before calling the IRS or mailing in a response.

How to Avoid Future CP518 Notices

- File your return on time every year.

- Use e-file services to reduce errors and speed up processing.

- Check your withholdings using the IRS Tax Withholding Estimator to avoid surprises.

Need Help?

Don’t let a CP518 notice create unnecessary stress. James K. Lazzara specializes in resolving IRS issues, including filing overdue returns and handling Form 15103. Based in Greensburg, PA, I offer tax preparation and IRS representation services to taxpayers in all 50 states. Contact me today for a free consultation to discuss how I can help you resolve your prior-year tax issues.