Disclaimer

This article is written for informational purposes only and should not be considered formal tax advice. Reach out to a tax professional for guidance before making decisions regarding your taxes or finances. Additionally, this article only relates to quarterly tax payments to the IRS for federal tax liability. For more information about making quarterly tax payments to the Commonwealth of Pennsylvania, read this article: When do I have to make quarterly tax payments in Pennsylvania? For more information about making quarterly payments to your municipality, contact a tax professional or your local tax collector.

This article includes an advertisement for tax services.

Last updated by James K. Lazzara, EA on December 7, 2024.

For many self-employed individuals, understanding and complying with quarterly estimated tax payments is a critical aspect of managing their tax obligations. Failing to make these payments on time can result in penalties and interest, increasing the total tax liability. In this article, I will explain what quarterly tax payments are, how to determine whether you need to make them, how to calculate the amounts, and what to do if you miss a payment. All information provided is based on IRS guidelines and relevant sections of the Internal Revenue Code (IRC).

What are quarterly tax payments?

Quarterly estimated tax payments, or estimated tax payments, are payments made to the IRS by self-employed individuals and other taxpayers who do not have sufficient tax withholding throughout the year. Unlike employees, whose taxes are typically withheld from their paychecks, self-employed individuals and those with other sources of income (e.g., rental income, investment income) are responsible for making their own tax payments on a quarterly basis.

According to IRC §6654, taxpayers are required to make these estimated payments if they expect to owe $1,000 or more in taxes after subtracting their withholding and refundable credits for the year. Failing to make estimated tax payments can result in the assessment of penalties and interest on the underpaid amounts, which is discussed in more detail below.

How do I know if I have to make quarterly tax payments throughout the year?

Not every taxpayer is required to make quarterly estimated tax payments. You must make estimated tax payments for 2024 if both of the following conditions apply:

- You expect to owe at least $1,000 in tax after subtracting your withholding and refundable credits for the current tax year.

- Your withholding and refundable credits will be less than the smaller of:

a. 90% of the tax liability for the current year; or

b. 100% of the tax liability from your prior year (110% if your prior-year adjusted gross income exceeds $150,000, or $75,000 for married individuals filing separately).

These requirements are set forth in IRC §6654(d). If your withholding is sufficient to cover your tax liability or you are otherwise exempt (e.g., you were not required to file a tax return in the prior year), you may not need to make estimated payments.

Certain taxpayers are eligible for exceptions, such as farmers, fishermen, and some higher-income taxpayers. The detailed exceptions are outlined in IRS Publication 505, which should be reviewed if you think you may qualify for an exemption.

When are quarterly tax payments due?

For taxpayers who file on a calendar-year basis, quarterly estimated tax payments are due on the following dates:

- 1st Quarter: April 15

- 2nd Quarter: June 15

- 3rd Quarter: September 15

- 4th Quarter: January 15 of the following year

Note that the payment due on January 15 applies to the prior year’s tax liability. For example, the payment due on January 15, 2025, would cover income earned in 2024.

It is important to be aware that if any of these dates fall on a weekend or federal holiday, the due date is typically extended to the next business day. To avoid penalties, be sure to make payments by the due date specified by the IRS.

How much do I have to pay every quarter?

Considering the rules regarding when you are required to make estimated payments, there are generally two ways you can calculate how much you need to pay every quarter: either paying at least 100% of your prior-year tax liability (110% for higher-income earners); or at least 90% of your current-year tax liability. You can use Form 1040-ES to calculate your estimated tax payments for the year.

Unfortunately, the process of estimating your current-year tax liability can be complicated, putting it outside the scope of this article. The amount of taxes you expect to owe may also change throughout the year if your income is inconsistent or variable. This is why many self-employed taxpayers who do their own taxes choose to pay based on their prior-year tax liability rather than estimating their current-year liability.

As an example, let’s say that you estimate your business to earn $40,000 total in 2024 and owe $10,000 in federal taxes. You decide that you are going to make your payments based on your current-year taxes. You would divide your estimated tax liability by four, meaning you would have to make four quarterly payments of $2,500.

Now imagine you’ve already made two quarterly payments for the year, and you realize your business has been making more money than you anticipated. You now expect to earn $60,000 of income for the year and owe $15,000. Now you not only have to increase your subsequent payments to adjust for the higher tax liability, but also make adjustments for the fact that your two payments of $2,500 were not sufficient. If your income is highly variable or erratic, you will likely need to recalculate your tax liability and adjust your payments each quarter. This variability makes it much more likely that you will either overpay or underpay, and potentially incur additional penalties or fees.

Consider if you had instead opted to pay based on your prior-year tax liability. For the purposes of this hypothetical, let’s say it was $12,000. You would simply divide the prior-year tax liability of $12,000 by four, resulting in four equal payments of $3,000 every quarter.

In almost every case, it is much easier to calculate your quarterly tax payments based on your prior-year liability rather than estimating your current-year liability. However, if you expect to owe significantly less in taxes during the current year than you paid last year, there may still be benefits to estimating based on current-year liability.

Can I make payments more often than every quarter?

While the IRS requires that estimated tax payments be made at least quarterly, you are welcome to make payments more frequently if you prefer. Many self-employed individuals choose to make monthly payments, which can help with cash flow management and ensure they don’t miss any payments. From the IRS’s perspective, the frequency of payments doesn’t matter as long as you meet the required quarterly deadlines. More frequent payments simply help you keep better track of your obligations.

How do I make quarterly tax payments?

There are multiple ways to make your quarterly estimated tax payments. The IRS offers several convenient options:

- Online Payment: You can make payments electronically through the IRS Direct Pay system, or by using the Electronic Federal Tax Payment System (EFTPS). Both systems allow you to pay directly from your bank account.

- Credit or Debit Card: You may pay by credit or debit card through third-party processors, though this method may involve fees.

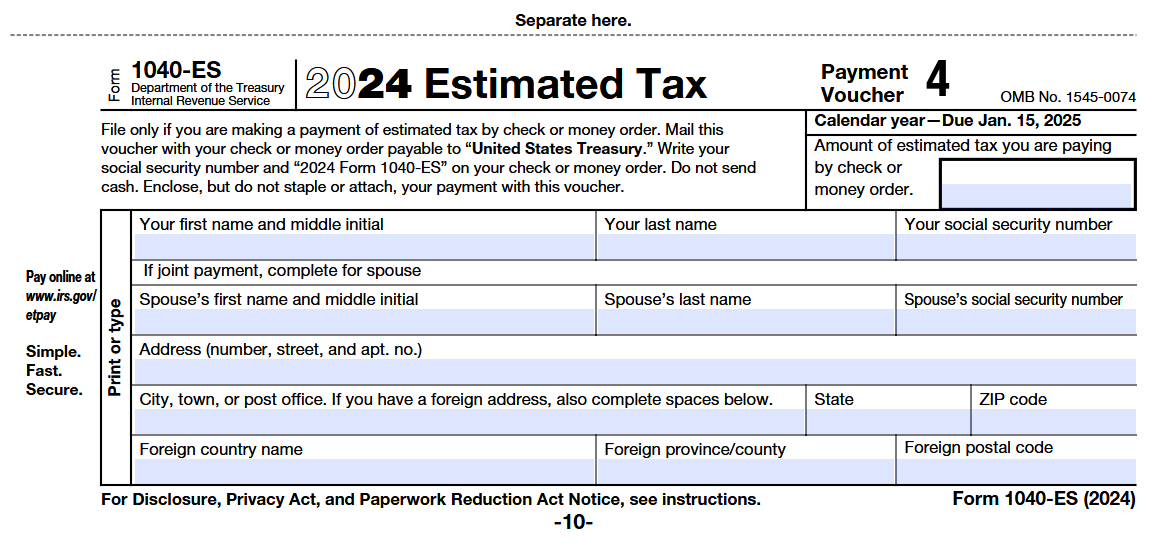

- Check or Money Order: You can mail a check or money order along with your payment voucher, which is provided on Form 1040-ES.

- Cash: In some cases, you can make payments in cash at participating retail locations using the PayNearMe service.

Regardless of how you make your payment, be sure to track your payments using Form 1040-ES, which allows you to record your estimated payments and ensure they are calculated correctly when you file your annual return.

What happens if I don’t make quarterly tax payments?

Failure to make estimated payments can result in additional penalties for underpayment, along with accumulated interest on the unpaid tax liability. The IRS charges an interest rate for underpayments, which is updated quarterly. The IRS will provided an updated table of interest rates on their website. You can use Worksheet for Form 2210, Part III, Section B to calculate the underpayment penalty owed if you have $1,000 or more in late tax payments.

Where to Find More Information

Before making your quarterly payments, you should strongly consider reviewing the following IRS publications:

Why should I consider hiring a tax professional?

Taxpayers often choose to handle their quarterly tax payments independently to save money. However, the complexities of tax calculations—especially for self-employed individuals or those with fluctuating income—can lead to costly mistakes. Incorrectly calculated payments or late payments may result in significant penalties and interest, outweighing any initial savings from handling the process yourself.

A qualified tax professional can help ensure that your estimated payments are accurate and made on time, potentially preventing penalties and reducing your overall tax liability. Additionally, tax professionals can assist with more advanced calculations or recommending strategies to optimize your tax situation.

If you’re feeling unsure about how to calculate or make your estimated tax payments, I encourage you to reach out for a free consultation. Let me help you stay on top of your tax obligations and avoid unnecessary penalties. Call 412-245-8788 or email me at JamesLazzara@proton.me today to schedule an appointment.