Disclaimer: This article is for informational purposes only and should not be considered tax, legal, or financial advice. For specific guidance, consult a tax professional or the IRS directly.

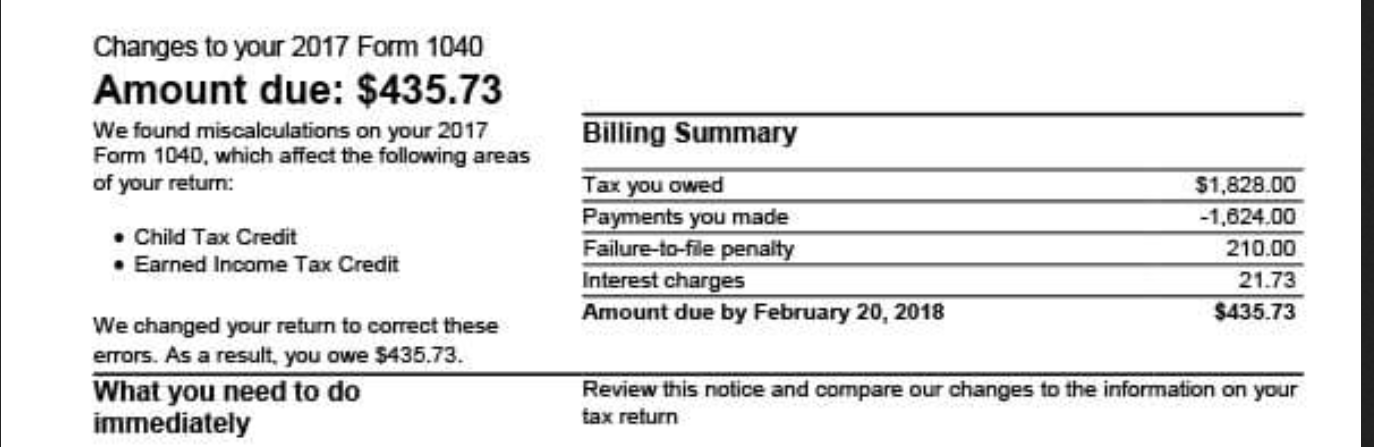

Receiving an IRS CP11 notice can be concerning, as it indicates the IRS has made changes to your tax return due to a miscalculation. As a result, you now owe additional taxes. Here’s a breakdown of what to do if you receive this notice and how to address it effectively.

What Is a CP11 Notice?

The CP11 notice is sent when the IRS identifies a calculation error on your tax return. This adjustment may increase your tax liability, and the notice will outline the specific changes made.

What Should You Do Next?

Review the Notice Carefully

The CP11 notice explains the adjustments made and why they were necessary. Compare it with your original tax return to understand the discrepancies. If you don’t understand the proposed changes or don’t agree with them, you may want to contact an Enrolled Agent or similar tax professional for assistance.

If You Agree with the Changes

Pay the amount due by the deadline stated in the notice.

Correct the copy of your tax return that you kept for your records. Do not send the corrected return to the IRS.

If You Disagree with the Changes

Respond Within 60 Days: Call the IRS using the toll-free number on your notice or send a written response. Include a copy of the notice and any supporting documentation.

Provide Necessary Information: If additional forms or documents are required, you may fax them during your call for faster resolution.

Important Reminder:

If no action is taken within 60 days, the changes become permanent, and your right to appeal is forfeited.

Avoiding Interest and Penalties

To avoid interest charges, pay the full amount by the due date. If you cannot pay the full amount, contact the IRS to discuss payment plan options or penalty relief. You may want to retain an Enrolled Agent or similar tax professional to assist in this process.

Tips to Prevent Future CP11 Notices

- File electronically to reduce calculation errors.

- Correct your records for the current tax year to reflect the changes made by the IRS.

- Use tools like IRS Form 1040-ES or consult a tax professional to adjust your estimated tax payments.

Need Help?

Don’t let a CP11 notice create unnecessary stress. James K. Lazzara specializes in resolving IRS issues, including filing overdue returns and handling Form 15103. Based in Greensburg, PA, I offer tax preparation and IRS representation services to taxpayers in all 50 states. Contact me today for a free consultation to discuss how I can help you resolve your prior-year tax issues.